Between a global pandemic and nationwide labor shortages, prices have risen higher than they have been in 40 years. As prices soar and the public eye stays trained on the benefit of higher ed in relation to its value, many universities must now decide whether their students will shoulder the rising cost of education or take other measures to divert expenses.

Mark Bullion, media and public information communications manager for Michigan State University, said, “Leadership remains very sensitive to the financial stresses students and families have experienced throughout the COVID-19 pandemic and our current economy’s inflation.”

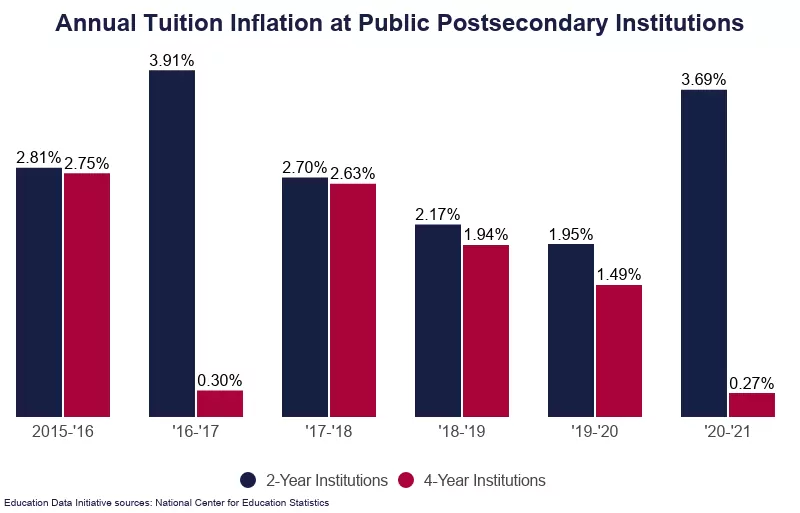

According to the Bureau of Labor Statistics, as of June 2022, the inflation rate was 9.1%, higher than it has been in decades, with an accompanying average tuition inflation rate of 8% as of August 2022. This increase is significant compared to the 3.11% inflation rate that four-year public institutions saw between 2010 and 2020. Notably, community colleges saw a more drastic increase of 43.4% during the same period.